high iv stocks meaning

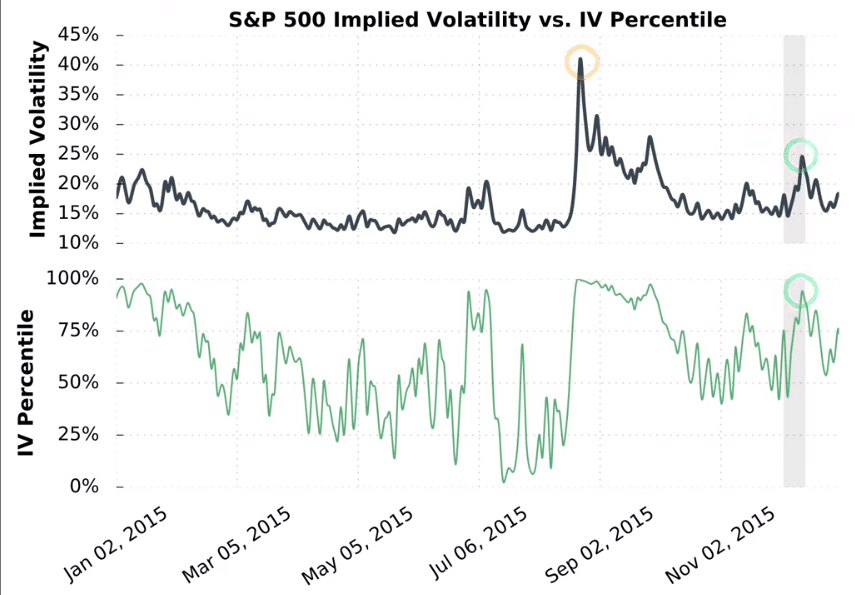

If the IV30 Rank is above 70 that would be considered elevated. A statistical method in mathematical finance in which volatility and codependence between variables is allowed to fluctuate over time rather than.

Implied Volatility Explained The Ultimate Guide Projectfinance

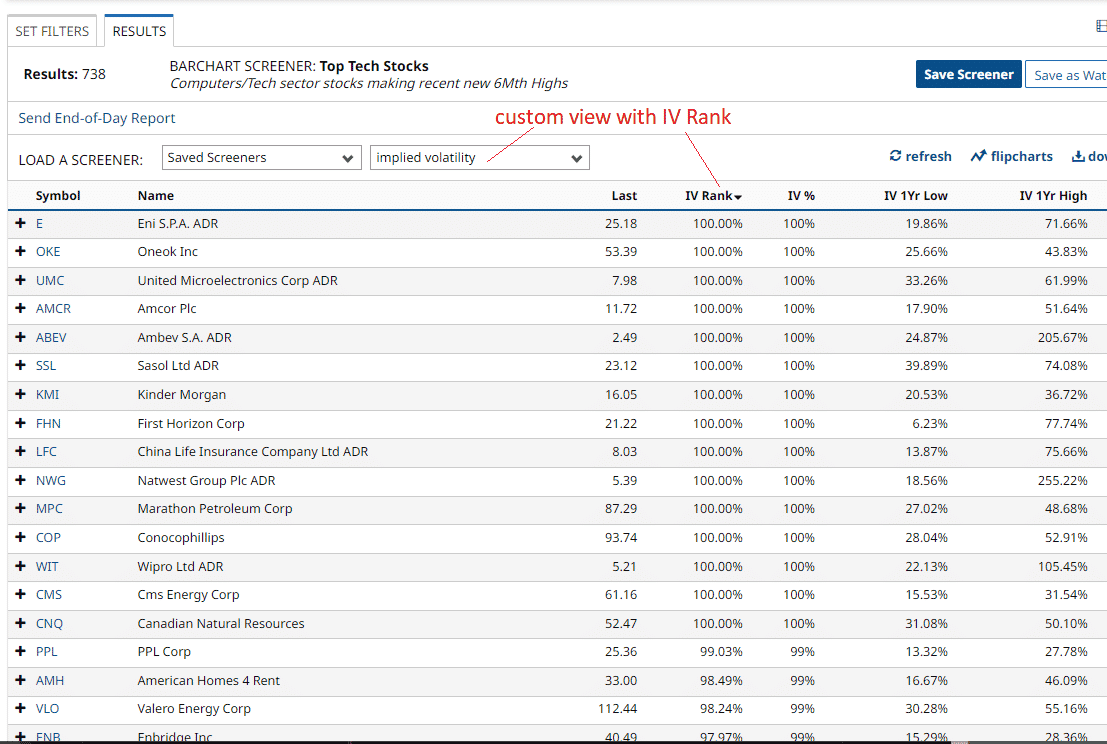

Market capitalisation above or equal to 1 billion.

. Implied volatility IV uses the price of an option to calculate what the market is saying about the future volatility of the options underlying stock. If IV Rank is 100 this means the IV is at its highest level over the past 1-year. Current implied volatility above or equal to 80.

Stock price above or equal to 5. Typically we color-code these numbers by showing them in a red color. What is Implied Volatility IV.

Add additional criteria in the Screener such. 70 would mean that over the past year 252 trading. High IV Options Trading.

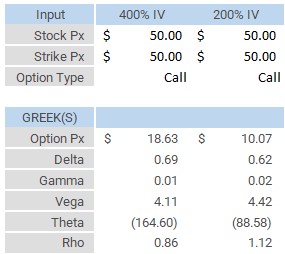

High IV strategies are trades that we use most commonly in high volatility environments. Put simply IVP tells you the percentage of. IV typically gets high when the company has news or some event impending that could move the stock I call it the event horizon and I refer to this kind of volatility as event volatility.

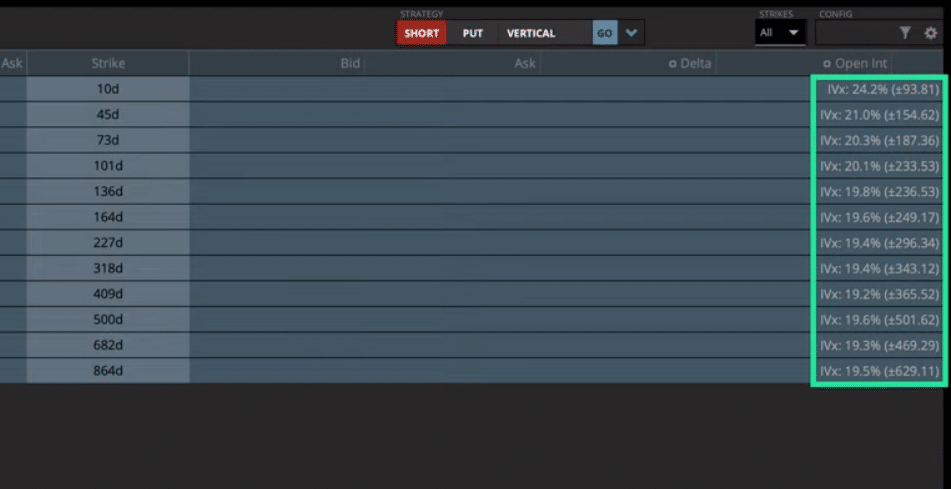

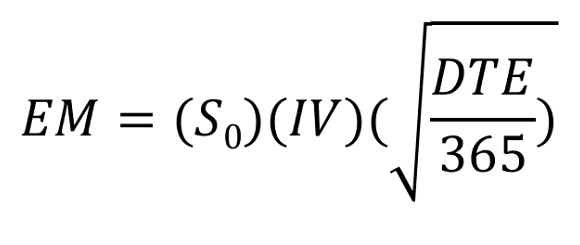

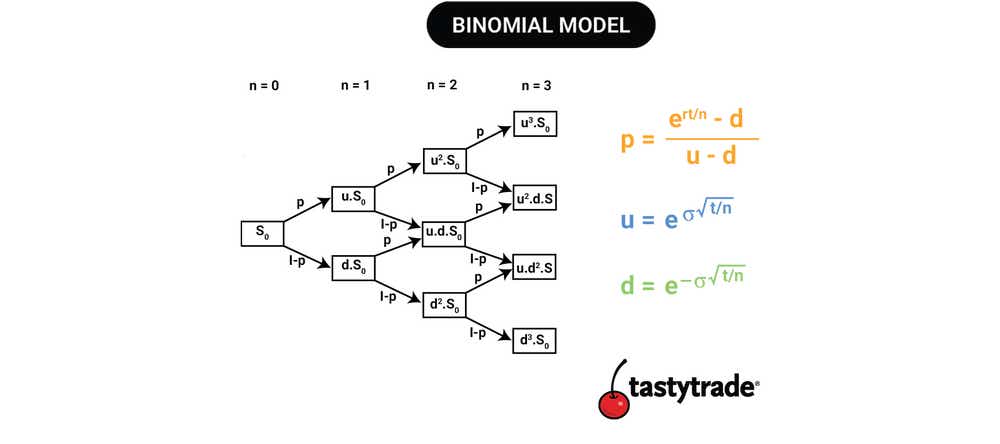

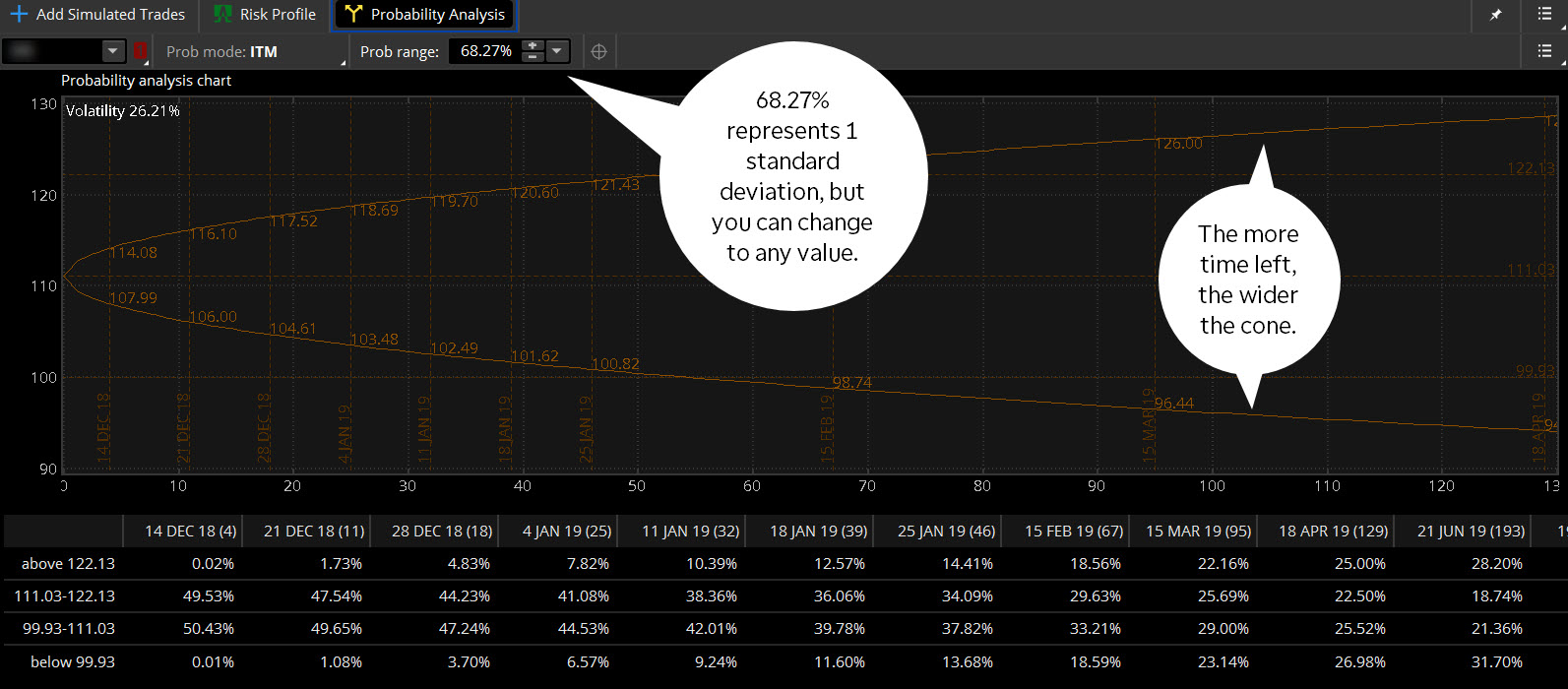

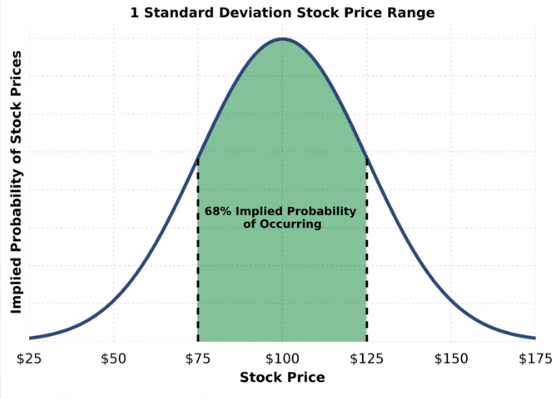

It also gives us an idea of how the market is perceiving the stock price to move over. As the implied volatility rank is very high close to the maximum of 100 it means that the option is in fact expensive when its historical implied volatility is taken into account. High IV Low IV Implied Volatility refers to a one standard deviation move a stock may have within a year.

If IV Rank is 100 this means the IV is at its highest level over the past 1-year. Stochastic Volatility - SV. Click Screen on the page and the Options Screener opens pulling in the symbols from the Highest Implied Volatility Options page.

Even more the 30 IV stock might usually trade with 20 IV in which case 30 is high. An options strategy that looks to profit from a decrease in the assets price may be in order. High IV Low IV Implied Volatility refers to a one standard deviation move a stock may have.

IV percentile IVP is a relative measure of Implied Volatility that compares current IV of a stock to its own Implied Volatility in the past. The main difference between IVR and IVP is the fact that IVR uses a range that moves as the high and low IV points are hit - for example if IV is so high that it is creating a new upper bound. When implied volatility is high we like to collect creditsell premium and hope for a contraction in.

High implied volatility is beneficial to help traders determine if they want to buy or sell option premium. If a stock is 100 with an IV of 50 we can expect to see the stock price move. An options strategy that looks to profit from a decrease in the assets price may be in order.

The scanner is useful. Your Saved Screener will always start with the most current set of symbols found on the Highest Implied Volatility Options page before applying your custom filters and.

:max_bytes(150000):strip_icc()/ImpliedVolatility_BuyLowandSellHigh2-2f5a33f6dde64c808b4d4775a258d3d7.png)

Implied Volatility Buy Low And Sell High

Implied Volatility Iv In Options Trading Explained Tastytrade

What Is Considered High Implied Volatility

Implied Volatility Iv In Options Trading Explained Tastytrade

What Is Implied Volatility Option Value Calculator

What Is Considered A High Implied Volatility Quora

What Is High Iv In Options And How Does It Affect Returns

Implied Volatility Spotting High Vol And Aligning Yo Ticker Tape

How To Keep The Gamma Squeeze Going With Put Sales Spotgamma

Selling Options For Free Money Her Wealth Journal

How High Is High The Iv Percentile By Sensibull Medium

.png?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

Implied Volatility Iv In Options Trading Explained Tastytrade

/stock-market-836258860-d77c2ae20cf849a491583ed4008547e4.jpg)

Implied Volatility Iv Definition

Options Volatility Implied Volatility In Options The Options Playbook

Understanding Iv Skew Traders Exclusive Market News And Trading Education With Trading Videos On Stocks Options And Forex From The Exchange Floor Of The Cme Group Via Articles On Trading

Implied Volatility Rank Iv Rank Registered Investment Adviser

Implied Volatility Explained The Ultimate Guide Projectfinance